FinTech software development: Industry trends

artificial intelligencee-commercefintechmachine learningpayment apptechnologyFinTech or financial technology is experiencing the acceleration of positive change these days. Advancements in this industry are meant to help financial services companies and their clients who use those services to navigate risks, avoid overspending, and generally better manage their finances.

From biometric security systems to open banking – let’s look into some of the hottest trends in FinTech software development that may turn a finance-oriented application into a high-demand product.

What is FinTech?

FinTech stands for financial technology and predictably means finance and technology coming together with a view to contributing and advancing innovative solutions for businesses and helping financial services providers better serve their customers. This all is supported by the use of technologies like blockchain, artificial intelligence, biometrics, eCommerce, and many more.

FinTech is not actually a piece of software. Neither is it a brand name. Instead, it shall be understood as a collective term for the technological trends we mentioned above. FinTech solutions also allow banking smarter and faster. Applied individually or in combination, they can make one’s business more efficient, helping more easily interact with customers, employees, or suppliers. In particular, the fintech technologies are capable of streamlining operations by consolidating multiple software into one fully digital ERP solution.

With the help of new-generation secure mobile applications, users do not have to waste their time on routine tasks. Making and tracking payments, sending alerts, receipts, or invoices becomes no problem with financial technologies at one's fingertips. Allowing for fintech, one can expect more opportunities to borrow money, new credit options, and generally more comprehensive access to innovation. Seeking mentorship and investors in this industry is not impossible, too. Last but not least, new revenue streams are created within this framework. Selling products and services online, taking payments digitally from anywhere and in any form that is legal and convenient for all the parties involved – that’s the reality that financial technology is creating.

Top financial services industry trends

According to the recent report by Statista, global growth in finance app usage during COVID-19 has been the most dramatic in Japan and equaled 55%. South Korea (35%), United States (20%), China (20%), Germany, and Italy (15%) followed the lead. Even before the pandemic, global investment in financial technology had been increasing. Though with a slight drop in investments in 2019 with $137.5 billion compared to $141 billion in 2018, FinTech has experienced positive growth in most of its sectors.

One way or another, the average usage of fintech apps worldwide is anticipated to only keep going up. Therefore, it’s high time companies operating in the financial technology sector and developing innovative technological solutions picked up momentum, found their niche, and empowered their business with one or a number of the fintech trends we’re about to discuss.

1. Solutions to support financial literacy

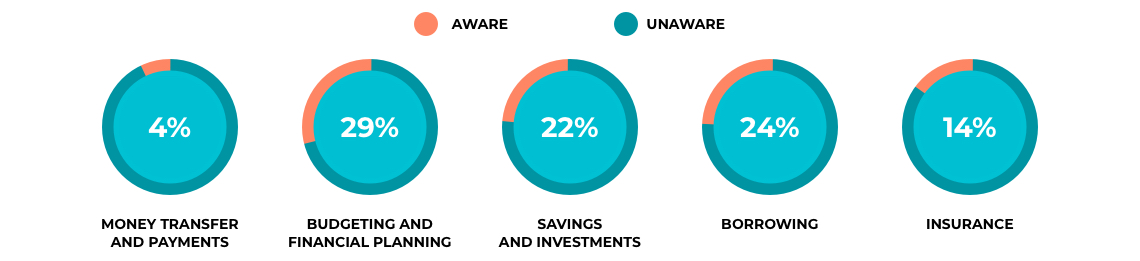

It is the users’ pains, needs, and demands that drive the development of the financial industry. The higher the customers’ awareness of the existing fintech possibilities, the better the chances to meet the demand. For instance, according to the recent survey by EY, consumer awareness of FinTech services in the five key categories is reported to be the following:

Another concern is that once you become aware of the possibilities, they must be handled in such a way for you to derive maximum benefits from them. Fortunately, there is a way to achieve that. Solutions to support financial literacy are being designed to help customers who are bad or just not careful enough with money. At the end of the day, people who are good with money are advantageous for fintech services providers in the first place. Investing in their financial literacy, these companies can earn loyal customers for the long term.

Advanced financial coaching solutions should not necessarily be stand-alone. They can be in-built in your primary application as well. Educate customers on how to spend their money wisely, save more without trimming one’s sails and cutting costs to the bone, and invest in such a way so that to make a profit from it.

2. Biometric security systems

Mobile banking and other financial services become widely available – they are literally at the tip of one’s fingers. This, in itself, being an unbelievable achievement, at the same time, raises lots of security-related questions. Meanwhile, cybercrime increases day by day.

Therefore, it is essential for organizations operating in the FinTech industry to take all the available security measures. And biometrics is the best way to bring security to the next level, providing users with the confidence that their data is protected. Currently, however, the biometrics market is witnessing major shifts under the pressure of the circumstances. Biometric sensors that involve physical contact are forecast to drop in popularity. Despite the overall growth in the usage of biometric technology for identity verification, contactless solutions are going to take over the touch-based fingerprint reader market.

Reportedly, as it is highly recommended now to avoid using cash, the COVID-19 pandemic keeps fueling the growth of the biometric payment cards market. Public health concerns have created more interest in contactless biometric identification solutions. Contactless financial cards had become commonplace before the crisis, but even more changes towards contactless smart access systems are to come.

3. Autonomous finance

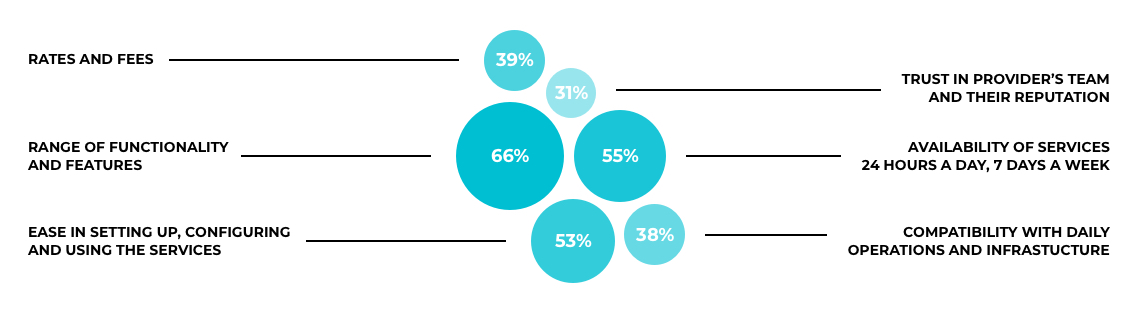

Fintech apps are the fundamental building blocks for autonomous finance. They reshape the way people interact with money, becoming services of choice for many of us in particular due to the benefits specified in the figure below:

These qualities of financial technology lay the ground for further developments such as autonomous finance. Conceptually, autonomous finance revolves around the idea of self-driving funds. Not only the technology helps customers make instant decisions about their money in terms of where to invest it, how to approve the loan at more favorable interest rates, or what to do with the overdrawn account, it actually performs all those tasks for you.

The autonomous finance started from robo-advisors that were concerned with software-based financial planning (like the one concerned with setting retirement goals) and mutual funds management. Later, it has evolved into automatic-saving applications and, eventually, into credit card debt management solutions, like the ones that help with student loans. Basically, the autonomous part is that fintech services use the power of AI and machine learning to manage user’s money. Such applications algorithmically evaluate the available options and assist a user in leveraging the most advantageous ones.

4. Open Banking

Open banking is a revolutionizing technology that brings FinTech and banks together, enabling data networking across institutions. Directly related to PSD2 (Second Payment Services Directive), it forces banks to release their data in a secure, standardized form for information to be shared more easily between authorized organizations online. It allows controlling consumers’ banking and other financial information by third-party applications through data sharing with the help of APIs and AI.

Many industry players now predict open banking will reshape the banking sector as we know it. And not without reason. Open banking is reported to have generated $7.29 billion in 2018 and is expected to reach $43.15 billion by 2026. Financial institutions need fintech, and fintech requires community banks and credit unions. And emerging from this demand, open banking partnerships can provide customers with a truly consolidated view of their financial accounts so that they could be easier to manage. As a result, access to open banking products and services is expected to promote better financial decision making, lower debt, and improved long-term wealth generation, thus benefiting the banking institutions, fintech workers, consumers, API industry figures, and even underserved communities.

Although it allows banks to open up, open banking also raises some unresolved issues like data security and management of security threats. But awareness and collaboration across the institutions can help avoid trouble and create value-added services for people.

5. Digital-only banks

The growth of digital-only or FinTech banks is one of the biggest most recent trends. Banks that provide all their banking facilities online without having a physical branch or premise do not have to bear with long lines or excruciating paperwork. At the same time, clients will only need a PC or a smartphone to manage their finances.

Mobile banking apps are not new to the market. Most well-known, established banks around the world have them. Not surprisingly, it was fintech that had traditional banks to innovate in this way. However, there are counterparts in the market capable of maintaining adequate competition. The digital-only approach is the innovation that is being actively and successfully promoted by new-generation financial start-ups. Ally, Revolut, Monzo, Monese, and many-many other digital banking platforms continue causing quite a ripple in the financial world.

Digital-only banks have the advantage of flexibility, and what is more, they normally offer innovative services at much lower rates than legacy players. In fact, it is reported that consumer visits to banks are to drop 36% from 2017 to 2022, and mobile transactions are to rise by 121% within the same timeframe. That is a rather favorable prognosis for digital-only banking, don’t you agree? It will be no exaggeration to say that digital-only banks pose a true threat to traditional banks, as they attract younger, internet-savvy customers who need simpler ways to manage their finances. And the news is good not only for fintech companies but in the first place for customers who should expect fierce competition for the attention of the clientele and the resulting rise in the service quality.

6. Voice technologies

Some, if not most, tech trends depend on what Gen Z wants. And there is more evidence that they want chat-like platforms for everything they need to deal with on a day-to-day basis. Voice assistants are already there to provide such experience. AI-powered voice technology has evolved to not only be able to tell the weather forecast or play a song but also to improve customer service in the banking sector.

First, voice assistants can serve as an automated support agent by providing basic data on the user account or card balance, replying to typical clients’ questions, setting up recurring payments, categorizing calls, and directing customers to the right places. Second, the customer’s voice can be used as biometric data to authorize payments, which is also known as so-called voice payments. And consumers become ever more comfortable with this type of banking. At the end of the day, voice payments' potential is extraordinary – from rerouting funds between accounts to sending money to friends via platforms like Venmo, Square Cash, or PayPal. The only concern is customer trust that emerges from their fear of security breaches. A valid point, but it’s still unlikely that banks will risk their clients’ security only to introduce new cutting-edge technology. Reputation is everything, and the demand for voice recognition must push providers to make the banking experience better without sacrificing user security.

7. RegTech in financial services

RegTech stands for regulatory technology. It is predicted to change the regulatory landscape by offering technological advancements to the highly regulated financial industry. Regulatory oversight is everything for this sector of the economy, which is why businesses spend huge funds on it in order not to pay even more if or when a breach happens.

RegTech basically enables companies to leverage advanced software that will simplify the compliance process with the existing laws and regulations. All regtech solutions can be divided into identity management, regulatory reporting, transaction monitoring, risk management, and compliance software. With the help of RegTech banks and other financial institutions can dramatically reduce administrative overhead, protect customers, and ensure financial stability for everyone. On top of that, the technology is praised for the speed, agility, integrative power, and analytical capabilities it ensures.

Technically speaking, the enormous volumes of regulation requirements are handled using automation, powered by big data and machine learning. These automated RegTech software solutions are programmed to examine and learn from the patterns found in large pools of historical data. Thus, it becomes easier to pinpoint problematic cases or even reveal fraud.

Conclusion

The financial services industry development is accelerating. The FinTech trends we’ve discussed above have emerged in response to customers’ demand. They actually help providers deliver better services that allow for increased access to financial information, improved transparency, quicker transaction processing, more secure identity authentication, and better support for the customer lifecycle.

The FinTech revolution is picking up momentum. So, in order to not be left behind, listen to your clients, earn their trust by creating transparent and seamless experiences, respect them and their privacy, look out for industry trends and always choose to make tech investments aimed to align the recent technological developments with what people want.

© 2022, Vilmate LLC