Since the beginning of human time, the need for home has been fundamental in the hierarchy of needs. People will consistently need a place to live. So the sphere of real estate will never lose its actuality.

Buying a house or an apartment can hardly be called a mundane purchase. And even small-scale transactions may involve substantial sums of money. It inevitably makes buyers and sellers sense a certain amount of suspicion.

More than that, some third parties get involved. Agents, inspectors, notaries, and others, add obscurity into the process. And that, consequently, leads to an even greater lack of trust.

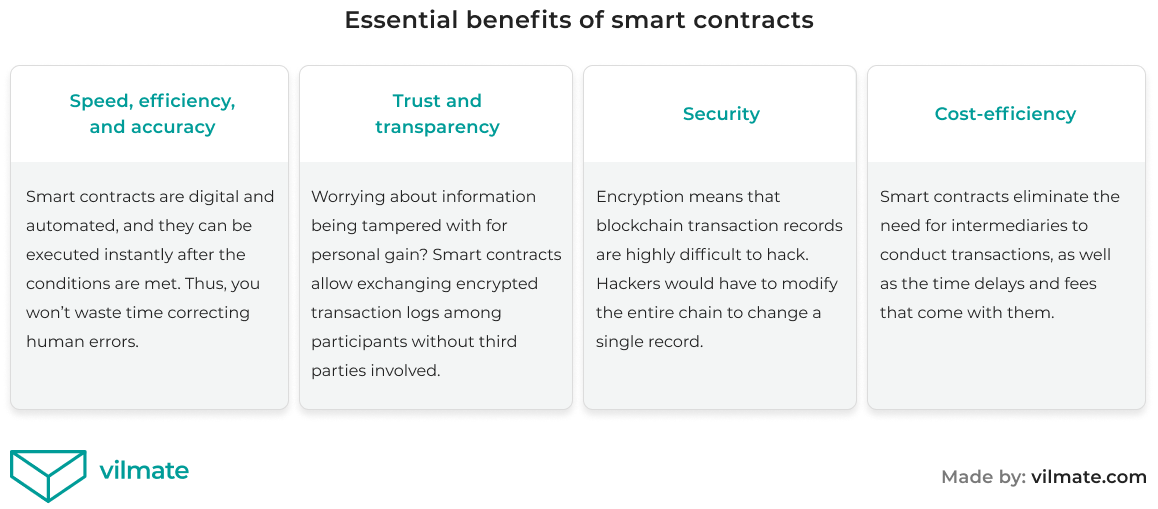

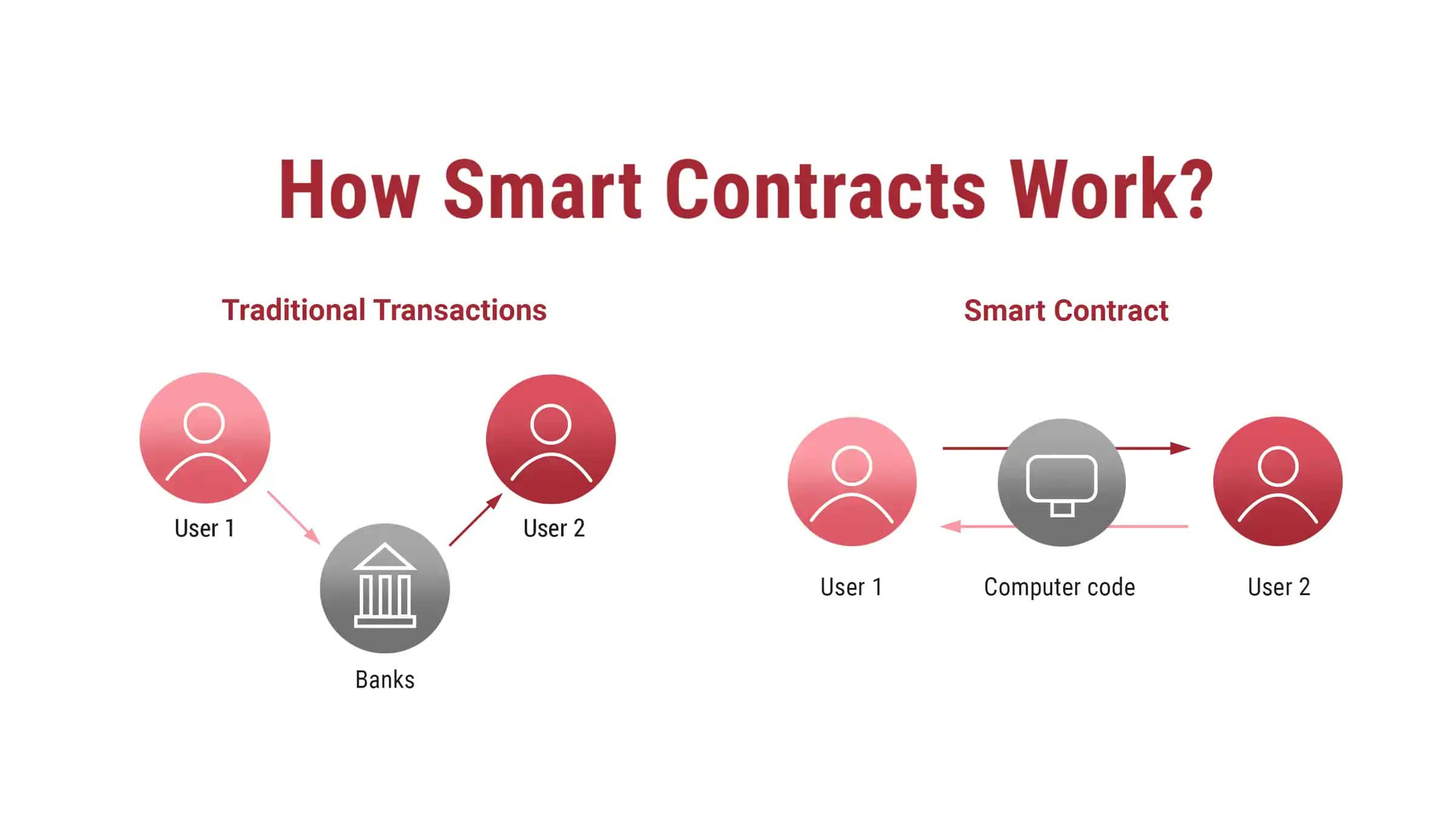

Yes, that’s what we call a vicious circle. But there is a way! Smart contracts in real estate cross out the need for intermediaries to handle transactions and, as a result, associated time delays and fees.

Smart contracts technology provides the process with significant benefits that you can find in the image below.

But is it really the future of real estate? It’s time to find out.

Blockchain as the keystone

To move on with our story, we have to take a closer look at the technology which sets the core of such well-known things as Bitcoin and Ethereum.

The term ‘blockchain’ is relatively new. Though, the concepts it combines start their way back from the early 90s of the 20th century. The key features that a typical blockchain includes are as follows:

- Decentralization

- Transparency

- Censorship resistance

- Independence from third parties

- Neutrality regarding its users

Let’s take a brief look at the way blockchains hold such a challenging set of advantages.

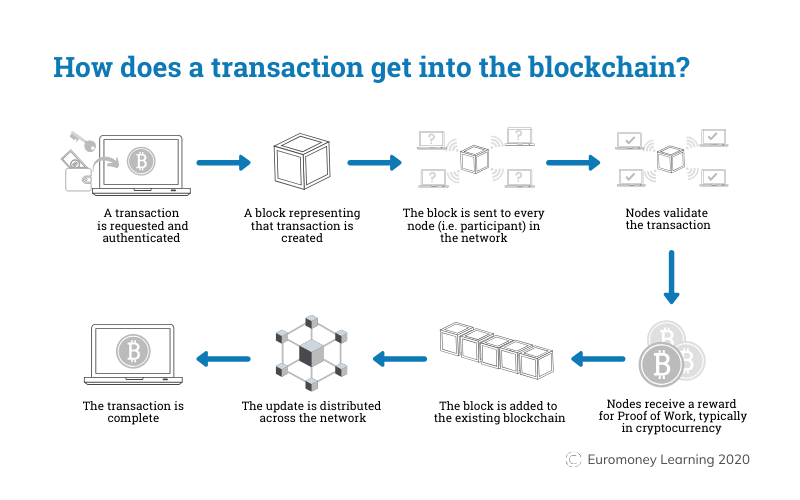

A blockchain is a collection of data sets, called blocks, bound together in a chain and distributed publicly among peers.

Of course, a properly operating P2P network with a certain amount of equally privileged bonds is an obligatory condition. Though, in the 21st century, with the current level of internet development, it can hardly be called an issue.

Each block typically contains a set of records, including details of a valid transaction and a cryptographic hash of its own and the prior block. Once the block is set into a chain and validated by a consensus algorithm, it becomes immutable.

Due to encrypted binding with the blocks by its ‘sides’, any data modification will affect the whole system back and forth. That’s how altering data can easily be spotted.

Such a simple but highly efficient approach found its way into cryptocurrency only a couple of decades later, making it market adoptable.

The first digital currency that comes to mind is Bitcoin. Unlike the traditional financial turnover, where banks or other centralized authorities validate transactions (even paper notes have their unique numbers), Bitcoin utilizes the proof of work algorithm to fill the transactions with authenticity.

You can dive into the explanation of the proof of work algorithm in the video below.

The key thing is that regardless of the type of algorithm adopted, the details of every transaction are stored as an immutable open ledger. It makes the picture as transparent as it can be.

And now, let’s move on to the point which allows data and value to be verified, stored, and transferred securely inside a blockchain system.

Tokenization in Blockchain explained

In a nutshell, a token is a digital asset that can represent anything, even real-world items. It’s a digital proof of the ownership of a specific piece of value, which can be moved, stored, or recorded on a blockchain.

Let’s say you own a massive bit of gold. You can transform its value into 2 digital tokens and pass one to your truelove and another one to your mum.

Keep in mind that those transactions will create a record on a blockchain. It would mean that your parent and your mate now have a digital proof of owning half of that particular entity, half of the gold in our case.

But what if your possession is unique or indivisible? Not a problem. Not all the tokens are the same.

What makes a token fungible versus non-fungible?

If a token is fungible, it can be replaced by another one without affecting the value. Well, imagine 2 users simultaneously exchanging a similar amount of bitcoins. It wouldn’t make any difference for them in terms of gained or lost value. The only thing that would change is a transaction record.

Or imagine switching real banknotes of the same nominal ‒ your purchase power wouldn’t change.

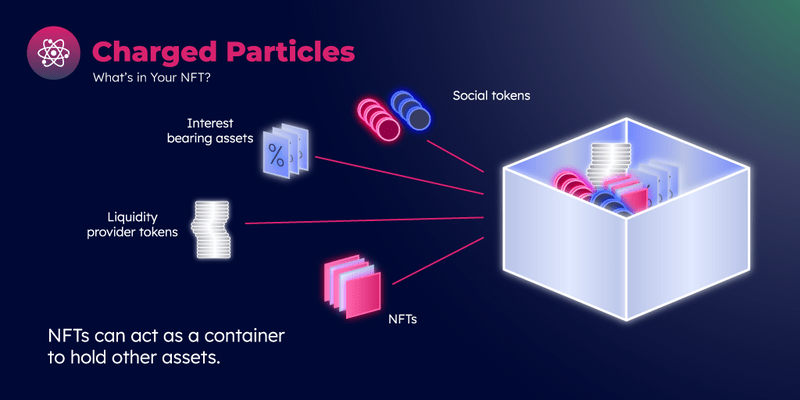

Another story is about non-fungible tokens (NFTs). By being non-fungible, it understands a uniqueness of some sort. Basically, it serves as a digital certificate proving the ownership of an indivisible unique entity.

NFTs are usually characterized like this:

- Indivisible

Unlike fungible tokens that store value, NFTs store solid data about an asset.

- Transferable

Whereas the entity an NFT represents is unchangeable, you can switch the owner of it by making a record on a blockchain.

- Fraud-proof

All the manipulations made can easily be traced via a blockchain.

- Programmable

You can set your own value on your NFT. Moreover, they can serve as a container for storing multiple values.

How smart are your contracts?

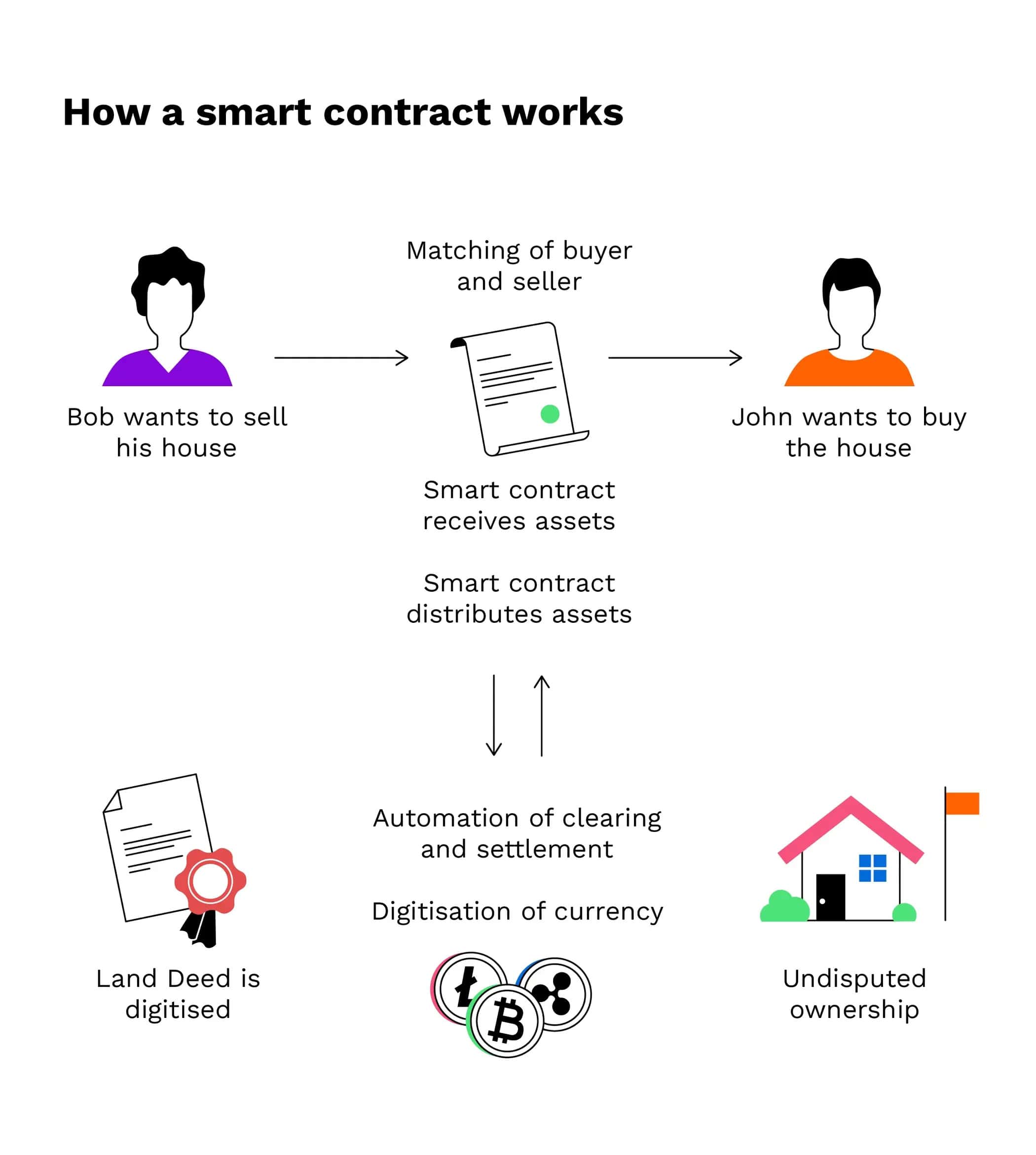

As we’ve figured out the general concepts a public blockchain glues together, let’s give a glance at one more aspect to complete the picture. What is a smart contract? And how does it work together with a blockchain?

Firstly, don’t let the word ‘contract’ deceive you. Despite its imperative nature, it’s not necessarily regarded as some legal agreement or obligation.

In our context, a contract is a small piece of software or even a protocol of a transaction. It serves as a warrant of the transaction execution. Once all the requirements set in a contract are fulfilled, it automatically conducts the deal.

The terms of a transaction have to be agreed by both parties in advance. And the program, serving a smart contract, doesn’t care much whether those terms are reasonable enough, correspond to the state law, or include some errors.

The burden of the appropriate contents of an agreement is still on humans’ shoulders. Smart contracts deal with the procedure only, ‘monitoring’ the fulfillment of the conditions, whatever they are.

The moment a contract is set, it remains solid and immutable till the deal is closed and recorded into a database. This is when blockchain technology comes in handy, giving transparency and saving from ‘trusted’ intermediaries.

So let’s look at these features in terms of real estate.

Smart Contracts ‒ the boost of Real Estate

An average person may experience the pleasant chores of purchasing some real estate for oneself or the family members only a few times in a lifetime.

Though, as we’ve mentioned before, the process of the ownership transfer might not be so pleasant. Due to extra fees, delays, and other headaches that go with the intermediaries, you’d have to arm yourself with patience.

But what if you want to skip those headaches? Smart contracts in real estate, with their features of automation and immutability, will save you from the trouble the human factor carries. The transfer of value becomes more efficient and secure.

According to Forbes, an anonymous buyer paid $23 million, entirely in cryptocurrency, for a penthouse in Miami. The deal, from start to finish, took less than 10 days. In terms of such a huge transaction, it can be called ‘an instant deal.’

But do you really have to be a multimillionaire to invest in real estate? The answer is No. The usage of tokens, serving the proof of ownership within smart contracts, expands the investment approaches.

Fractional ownership enables users to share the value of an asset and, therefore, the benefits it may bring. It means that the property, which only the wealthy had resources to purchase, is now more affordable for the community.

More to the point, smart contracts, alongside the blockchain capabilities, seem to fit perfectly for reducing or excluding paperwork at all. As well as the lion share of intermediaries!

As we can see, the cons of smart contracts grow dim in comparison with their pros.

Of course, a program can’t evaluate the quality of concrete or the conceptual importance of an interior design. But in terms of some less sophisticated, standardized transactions, it is, undoubtedly, in the power of smart contracts set in a blockchain to eliminate the human factor.

With all that said, let’s sum up the smart contract’s benefits:

- Transparency & Security

A public blockchain simply won’t let any monkey business stay out of sight.

- Efficiency

If a multi-million transaction was conducted in a matter of days, some minor transactions would take hours, or even minutes, to be handled.

- Cost-efficiency

What’s the difference between a notary and a piece of software? ‒ That’s right! The second one doesn’t need a paid vacation.

- Objectiveness

Nowadays, it’s hard to find a truly fair and unprejudiced judge. But they exist! And they are called smart contracts.

Conclusion

The idea of exchanging goods and services on a fair, stable, decentralized, public platform is definitely worth any efforts made. What is more, it’s controlled by the community itself, excluding corruption, bias, and delays.

Public blockchains, cryptocurrencies, NFT, and, last but not least, smart contracts in real estate serve a promising perspective not to be feared of.

Indeed, the concepts mentioned are perfect to be applied in such a conservative business as real estate. They serve as a democratizing force, opening new opportunities and lowering the barrier of entry into the business for a greater scope of people.

That’s why it’s safe to say that smart contracts in real estate are here to stay. Do you want to discover the fintech domain in more detail? Then contact us, and you will be well on your way to fintech success. Also, you can take a look at our portfolio and explore the solutions Vilmate team delivers.