Technological progress is the result of human activity. However, the presentation of automation, artificial intelligence, and machine learning principles has taken a fair share of work off our shoulders.

It means that workflows, customer service, and ways of doing business are transforming to open new opportunities, expel outdated techniques, and basically set the way for our more secure and confident future.

The sector of banking and finance is a good illustration of how businesses can adapt to contemporary concepts. In this article, we’ll discuss why fintech and machine learning join hands so easily, what actually stands behind machine learning in fintech, and which processes it can improve in the industry.

Machine Learning vs. Artificial Intelligence

To make the story clear, we need to realize that artificial intelligence and machine learning are not exactly the same.

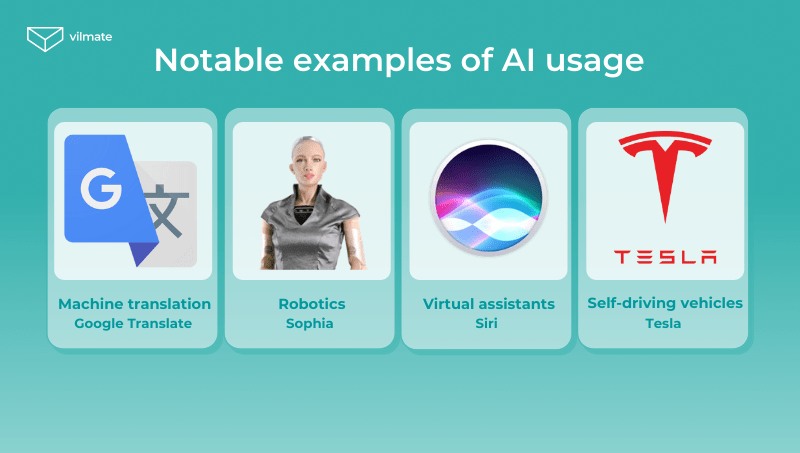

Artificial Intelligence (commonly referred to as AI) is the process of imparting data, information, and human intelligence to machines.

The purpose of AI is to develop self-reliant systems that can mimic human behavior. To achieve the goals and perform given tasks, AIs are applied with problem-solving abilities, i.e., task-reward systems.

Most AI systems simulate natural intelligence to solve complex problems. Some common examples you can find in the image below.

Machine learning (ML) uses computer algorithms and analytics to build predictive models that can solve business problems, including such from the fintech industry. ML is based on algorithms that can learn from data without relying on rule-based programming.

Footnote: rule-based programming is an application of a predefined set of rules for building the logic of automated actions. It’s aimed at manipulating some particular source of data.

The rule-based approach is more common for AI because of its convenience for building systems that simulate human behavior: trigger→processing (based on the rules’ set)→decision→action.

ML accesses vast amounts of data (both structured and unstructured) and learns from it to predict the future.

The terms may often be used interchangeably. But not all AIs include ML, and not every ML system pursues the goals of AI. And we won’t be touching deep learning and big data in fintech. Otherwise, this text will never finish.

So why was the banking and finance sector to be among the first to apply the benefits of AI and ML in fintech? Let’s talk about that further on.

AI/ML in Banking & Finance

As it was mentioned before, machine learning in fintech deals with data for predictive analytics and decision-making. Naturally, these benefits couldn’t go unnoticed by the companies working in finance and the related spheres of customer service.

The flows of figures and streams of data in fintech companies are endless in response to the market fluctuations, the activity of millions of customers, not to mention numerous attempts of illegal activity.

In such an environment, it would be close to impossible to keep track of the processes manually and form adequate reports regarding huge operating systems.

Here are only a few instances of ML and AI applications in financial services:

- Risk management

- Fraud analysis

- Sales forecasting

- Customer support

- Asset management

- Service personalization

- Product recommendations

- Stock price prediction

And now, let’s dive a bit deeper into the mechanics and practical appliances of machine learning in fintech alongside artificial intelligence.

AI/ML in fintech: What are the benefits?

The fact that smart solutions have been invading fintech companies for the past decade is undeniable. The use of machine learning in fintech and AI applications are present almost in every field, including the back-end and front-end.

The fintech sector is a broad term. But regarding the appliance of AI and machine learning adoption, one can’t miss the spot because it’s practically everywhere.

Starting from a banking app on your personal smartphone, fintech startups, and finishing with huge international corporations with massive financial streams, AI/ML tools are relentlessly doing their job.

According to Finextra, an independent fintech newswire, the demand for ML solutions won’t be falling any time soon, as the benefits they provide are a good stimulus.

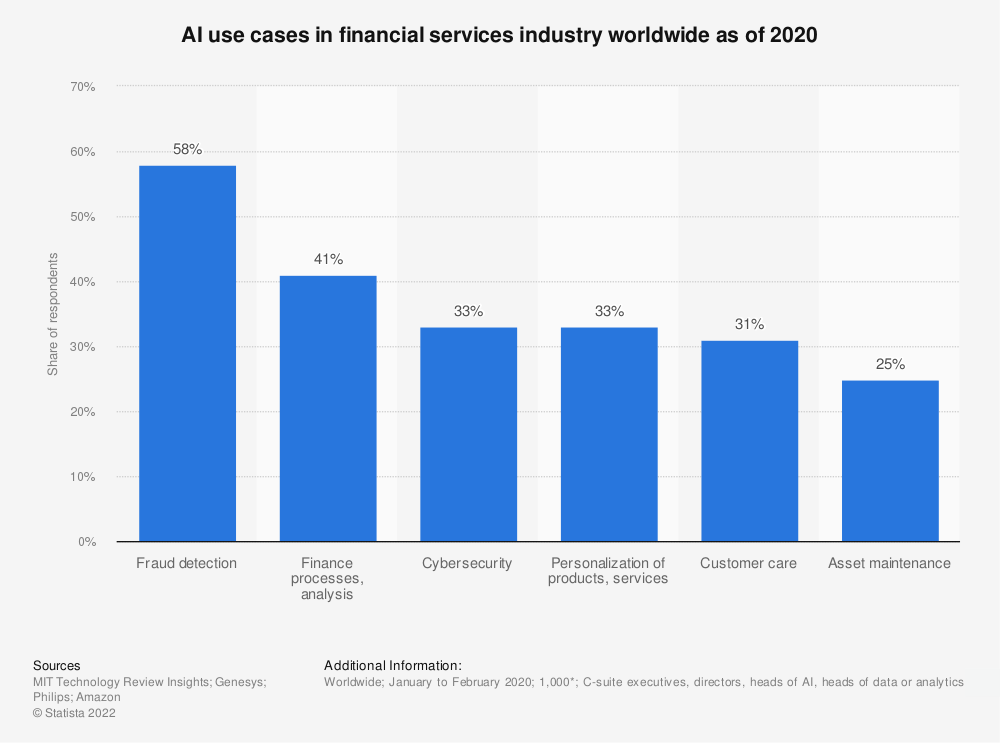

Statista, one more source common to rely on, states that AI use cases are global, diverse, and comprehensive. From cybersecurity to customer care, AI appliances manage to enhance financial operating systems both from developers’ and consumers’ points of view.

So what exactly can ML and AI applications in the financial industry improve?

In general, the list of benefits corresponds to what all the fintech companies, and not only, would like to see in their product. In their turn, the consumers are at any time ready to pay for a pleasing and reliable service experience.

- increased cost-efficiency

Automated processes require less staff to be involved

- advanced fraud prevention

Any abnormality can’t be left unnoticed by a properly adjusted operating system

- reduced biases

Predefined checks enable the system to be predictive and stable

- boosted customer engagement

Personalized settings motivate customers to be more involved in a product

- enhanced scalability

Your system can be easily adjusted to the scale of your business needs

- improved time-management

The algorithm works faster than you, don’t even doubt

And now, let’s look through some major applications that can’t skip the benefits machine learning in fintech provides, combined with AI features.

Decision-making & Credit scoring

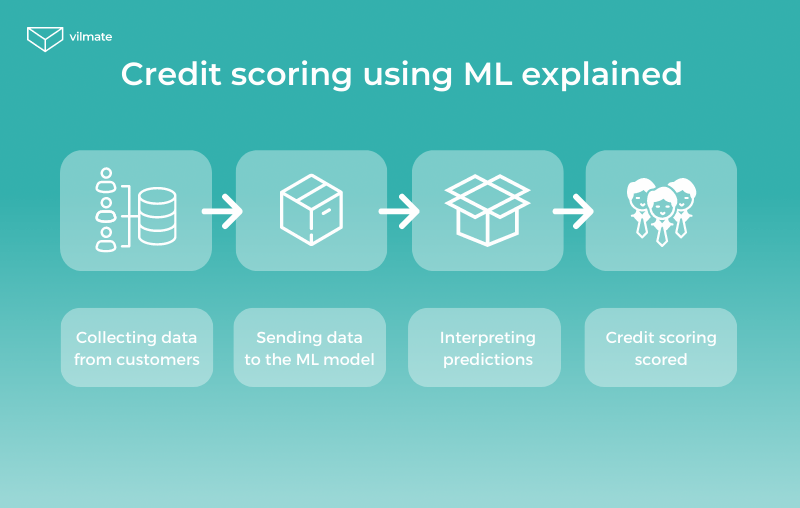

Predictive analytics is one of the biggest advantages that machine learning technology provides in the financial industry. And the fields of decision-making and credit scoring are getting more and more benefits from it.

Banking institutions and other fintech firms utilize machine learning algorithms to optimize money circulation by providing loans regulated with ML-based credit scoring systems instead of only rule-based.

But what distinguishes these two approaches? Rule-based credit scoring systems used to work with data about age, gender, occupation, and other general information about an applicant. Meanwhile, ML-based scoring systems can now work with more delicate settings and make decisions more accurately regarding a person.

By taking into account a person’s expense and saving preferences and some other digital tracks, one can make more personalized decisions about the performance of loans.

In other words, software based on machine learning algorithms may conclude that a reasonable pensioner turns out to be a more reliable borrower than an average adolescent. And it’s now a lot easier for the systems to identify this.

Security, Risk Management & Fraud detection

The biggest concerns for fintech companies and banking are undoubtedly fraud, security, and safety. Alongside goes risk management, as one should be perfectly aware of when and what to buy, what to sell, and when to press hold in the market.

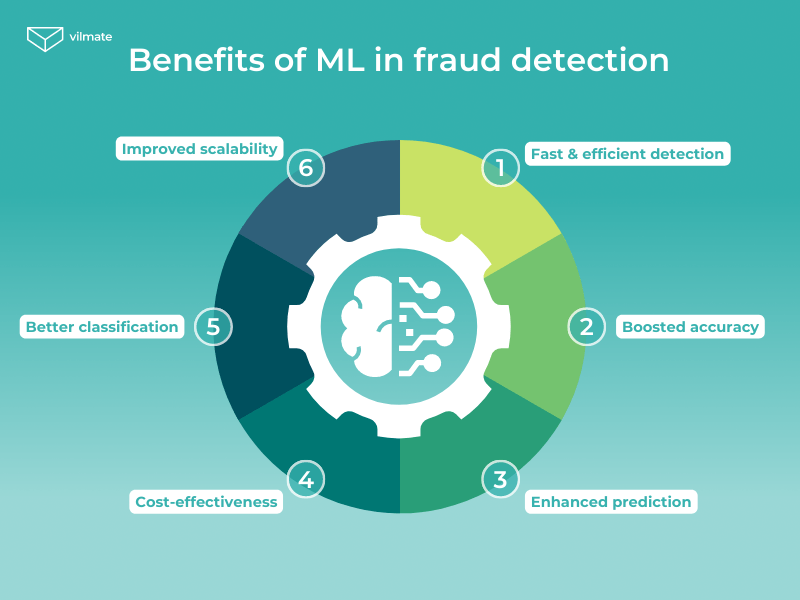

Predictive, analytical features of AI and ML in fintech make these tasks a lot easier. They maximize resource utilization and increase operational efficiency.

Below, you can see the main benefits of using machine learning in fraud detection.

Furthermore, the ability to spot suspicious activity and prevent fraud by using machine learning in fintech has become a powerful tool in the struggle with money laundering, financial criminals, and basically any kind of fraud.

For banks, stock markets, and the fintech industry around the world in general, it’s vital to provide trust and reliability for the clients to stay with them. So the emergence of AI and ML in fintech can be considered no less than a game-changer for financial technology.

Quantitative & Algorithmic trading

Thanks to mathematical models and machine learning algorithms, trading companies and even individuals are able to build strategies for execution to make a profit in the market. By conducting research on historical data and building statistical models, one can spot potential profitable investments quicker than competitors.

Below, you can find the main applications of machine learning in trading gathered by our team.

This way of trading, powered by machine learning techniques, has opened unforeseen opportunities for fintech companies. It enables them to make any desired number of orders on multiple markets, efficiently avoiding the risks of losing.

In addition, the predicted trades may also vary from short- to mid- to long- term, in correspondence with the ongoing marketing environment.

Personalized banking

We’ve already stated that machine learning in fintech allows banking institutions to build more ‘personal’ bonds with clients. But how does it actually work?

By tracking a client’s location, time, and expense habits (with their voluntary consent, of course), banking apps may ‘guess’ which service or product is relevant for the client at some particular moment.

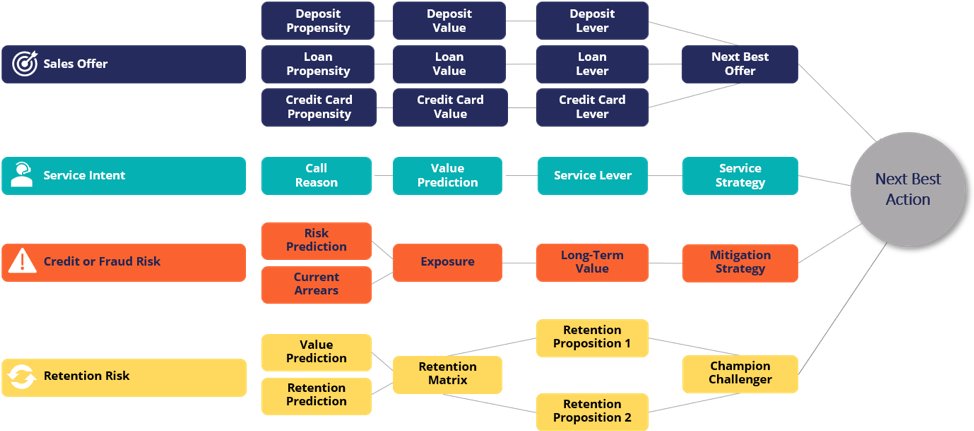

According to a veteran of the global consulting market,McKinsey & Company, banks will need to change their approach to stay afloat from 2030 onwards. Nowadays, banking institutions should be preparing to bring more individualized, unique, and advice-focused value to their clients.

Below, you can see the implementation of the 'next best action' approach in banking by the financial magazine The Financial Brand. Here, you can see that such a workflow requires historical and real-time data analysis that AI and ML are ready to provide.

Workflow optimization & Automation

The implementation of AI and ML in fintech may reduce a huge amount of manual work. Instead of a dozen doers, one properly trained employee, armed with an ML algorithm, acts as an observer. It reduces costs and gives faster feedback on any sort of malfunction, fraud, and extraordinary activity.

Words to finish

No matter which sphere your life is connected with, 99% that you’ve faced ML and AI applications in financial services, as a bank customer to the least.

As a part of the fintech industry, machine learning algorithms and AI applications play the role of an executive brain in a system that is never tired but always hungry for new volumes of data to process. Furthermore, no fraud stands a chance since AI/ML tools would easily spot any abnormality.

If you’re considering enforcing your project with the solutions of machine learning in fintech, or any other techniques, look through our Technology page to help make up your mind. Also, you can check our Portfolio to get familiar with real-life operating projects, where the Vilmate team has contributed their share.