A retail business that wants to stay competitive will eventually go online. Launching an e-commerce store opens up many opportunities, but it also brings essential responsibilities. Customers trust you with their most sensitive information to get the products they want. That’s why e-commerce website owners must focus on keeping data safe, ensuring strong cybersecurity, and protecting against fraud.

Without proper cybersecurity, an e-commerce website risks data breaches, which can seriously harm a business’s reputation and break legal requirements. In this article, we’ll look at what types of information e-commerce websites need to protect, the main threats from fraudsters, and how to prevent data leaks.

What Types of Information Do E-commerce Sites Need to Protect

A customer must share certain information with an e-commerce website to buy a product. Retailers collect this data to process orders, arrange deliveries, and improve marketing strategies. Let’s look at the types of information customers typically provide.

1. Personal Data

Customers share a lot of personal information when registering or placing an order. This includes their name, phone number for communication, and address for delivery. The website also collects the customer’s IP address.

Why would fraudsters want this information? Because it’s valuable. In the third quarter of 2024 alone, around 422.61 million data records were exposed due to security breaches, affecting millions of users worldwide. Criminals use personal data for various types of fraud, including:

- Phishing – sending fake emails or making calls pretending to be from well-known companies.

- Package interception – redirecting deliveries to a different address.

- Financial fraud – making purchases or taking loans under the customer’s name.

- Future attacks – selling stolen data on black markets.

Fraudsters are constantly finding new ways to misuse personal data. That’s why it’s essential to have strong cybersecurity measures in place and ensure sensitive information is stored securely.

2. Payment Data

Customers who trust your online store make purchases using online payment services. This requires the website to process sensitive information such as credit card numbers, expiration dates, CVV codes, and digital wallet details. For cybercriminals, this data is highly valuable. They can use it to:

- Make unauthorized transactions – withdraw money without the customer’s consent.

- Create fake accounts – place orders under the customer’s name.

- Sell the data on the black market – enabling large-scale fraud.

- Commit financial blackmail – demand payment by threatening to reveal private information.

To protect your customers and business, use secure data transmission protocols (like HTTPS), enable two-factor authentication, and partner only with trusted payment providers.

Protecting payment data is not just about earning customer trust. It’s also a legal requirement under standards like PCI DSS. The stronger your website’s security, the more comfortable and confident customers will feel when shopping with you.

3. Transaction History

Transaction history details past purchases, including the items bought, dates, and amounts. While this information may seem harmless, fraudsters find it valuable. They can use transaction data to:

- Send targeted phishing messages – referencing actual purchases to trick customers.

- Analyze shopping habits – creating scams that seem more believable.

- Fake returns or cancellations – to illegally obtain money or products.

- Access loyalty programs – stealing bonuses or discounts.

To minimize these risks, limit access to transaction history, use data encryption, and verify refund requests carefully.

4. Login Credentials

Usernames and passwords are keys to customer accounts. If cybercriminals steal them, they can:

- Access accounts – change personal information, place orders, or steal saved payment details.

- Use loyalty points – redeem discounts or rewards for themselves.

- Target other services – since many people reuse passwords across websites.

- Send scam messages – tricking contacts by using the customer’s account.

Strong password encryption, regular data breach checks, and two-factor authentication are the best defenses.

5. Communications and Messages

Customers often contact companies through online chats, emails, or contact forms. Imagine someone reading your private conversation—it’s an uncomfortable thought! Customer messages can include personal details, complaints, or questions about orders. Fraudsters use this information to:

- Send convincing phishing messages – pretending to be customer support.

- Find system weaknesses – by analyzing customer complaints and inquiries.

- Steal sensitive information – like payment details shared in chats.

- Blackmail customers or businesses – using personal conversations as leverage.

To protect against these risks, use secure communication channels and educate customers on how to spot fake messages.

6. Website and System Access

Gaining access to a website’s admin panel or server is a prime target for cybercriminals. Once inside, they can:

- Change website content – adding harmful links or altering prices.

- Steal customer data – including personal and payment information.

- Shut down the system – to demand a ransom or harm your reputation.

- Create fake website pages – to trick customers into sharing sensitive data.

Preventing these threats requires strong passwords, multi-level access controls, and regular software updates.

7. Business Financial Data and Reports

Company financial information includes accounting reports and details about revenue, expenses, and partnerships. If fraudsters get this data, it can lead to serious problems:

- Financial blackmail – threatening to reveal confidential information.

- Unfair competition – by sharing data with competitors.

- Fake payment requests – to steal company funds.

- Spreading false information – to damage your reputation.

To keep this data safe, implement layered access controls, encrypt financial reports, and work with trusted financial advisors.

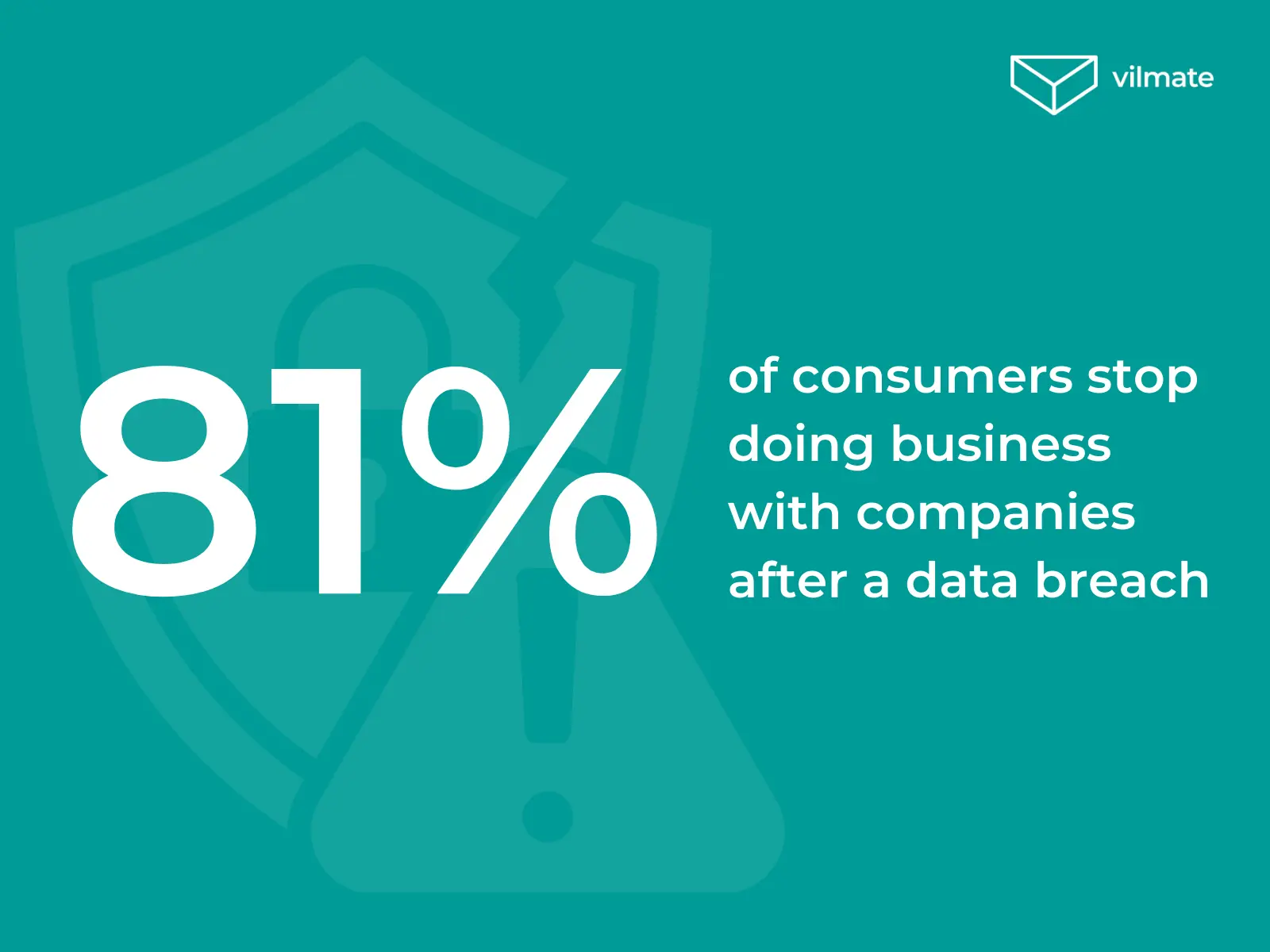

Protecting data isn’t just about security—it’s about trust. Around 81% of consumers say they would stop doing business with a company after a data breach. A strong approach to cybersecurity helps keep your customers and partners confident and loyal.

Next, we’ll look at common cyber threats and how to defend against them.

E-commerce Website Vulnerabilities: How to Handle Cyber Threats?

According to the 2019 Global Online Shopping Survey by 2Checkout, approximately 76% of online shoppers consider data privacy and security key factors when choosing an online store. This shows that customers are increasingly concerned about protecting their personal information.

So, what are the main security threats in e-commerce, and how can online retailers protect themselves and their customers from these risks?

Let’s find out.

Online Payment Fraud

Online shopping has become part of everyday life. People can order food, clothes, or electronics with just a few clicks. But with this convenience come new risks. Fraudsters constantly find ways to steal money through online payments.

When customers enter their card details on a website, that information can be stolen. This can happen through fake websites, computer viruses, or data breaches from online stores. Fraud becomes especially common during sales and holidays when people shop more and pay less attention to potential scams.

Common types of online payment fraud:

- Card Data Theft: A customer receives a message claiming to be from your store, asking to confirm an order. Thinking it’s a real request, they enter their card details and lose money.

- Friendly Fraud: A buyer receives their order but later claims they never made the purchase. As a result, the store loses both the product and the payment.

- Fake Online Stores: Scammers create websites with attractive discounts. Customers pay but never receive their purchases.

- Use of Stolen Cards: Criminals use stolen card details to make quick purchases before the card owner notices the fraud.

How can online stores prevent payment fraud?

- Follow PCI DSS Standards: The Payment Card Industry Data Security Standard (PCI DSS) rules are designed to protect credit card information. If your store doesn’t meet these standards, it’s best to use certified payment services that do.

- Use an Address Verification System (AVS): AVS checks if the billing address matches the one registered with the card issuer. If they don’t match, the transaction is flagged as suspicious. This helps confirm the buyer is the real cardholder.

- Install an SSL Certificate: An SSL certificate encrypts data entered on your website, like personal details and payment information. Without SSL, data is sent in plain text and can easily be intercepted by hackers.

- Require the CVV Code: The CVV code is the three-digit number on the back of credit cards. Asking for it during payment makes fraud more difficult, even if someone has the card number and expiration date.

- Implement Multi-Factor Authentication (MFA): A password alone is not enough. MFA adds an extra layer of security, requiring a code sent via SMS, a password generator app, or biometric verification. This makes unauthorized account access much harder.

- Use AI and Machine Learning to Detect Fraud: Modern technology can identify suspicious behavior in real-time. For example, if a customer who usually makes small purchases suddenly tries to buy expensive electronics from another country, the system can block the transaction and send an alert.

Securing payments isn’t just about technology—it’s about earning customer trust. The more you focus on security, the safer your customers will feel. A secure shopping experience encourages buyers to return and recommend your store to others.

DDoS Attacks

Imagine your online store is running a big sale, increasing customer traffic, and suddenly, the website stops working. Shoppers can’t place orders, and you lose both sales and reputation. This kind of disruption is often caused by a DDoS (Distributed Denial of Service) attack.

A DDoS attack occurs when many infected devices flood your server with requests simultaneously. The server can’t handle the load and the website crashes.

Why do cybercriminals target e-commerce websites?

How can you protect your website from DDoS attacks?

- Use DDoS Protection Tools: Modern security systems can detect and block harmful traffic before it reaches your site. These tools analyze incoming data and separate real users from bots.

- Configure Firewalls and Routers: Many DDoS attacks use methods like ICMP requests (pings) and DNS responses to overload servers. Adjust your network settings to block suspicious traffic, especially from outside sources.

- Choose Cloud Solutions with High Bandwidth: Reputable cloud providers offer built-in DDoS protection. Their global data centers and strong infrastructure can absorb large amounts of malicious traffic, keeping your site online.

- Set Up Load Balancing: Load balancers spread traffic across multiple servers. Even if an attack occurs, no single server becomes overwhelmed, helping your website stay fast and accessible.

The better prepared your online store is, the harder it is for attackers to take it down. For customers, a stable website shows that you are reliable and care about their experience. Strong protection keeps your business running and builds customer trust.

E-skimming

People often imagine phishing scams or computer viruses when they think about online data theft. But there’s another danger—e-skimming. It works silently, stealing customers’ information directly from the payment page, often without being noticed for a long time.

E-skimming happens when hackers insert malicious code into a website, usually on the checkout page. When customers enter their credit card details or personal information, the code captures the data and sends it to the attackers.

How do hackers insert malicious code?

- Exploiting website vulnerabilities: Outdated plugins or an unpatched CMS (Content Management System) can have security gaps that hackers exploit.

- Targeting third-party services: If your site uses external scripts (such as those for live chats or analytics), attackers can compromise these services and inject harmful code.

- Using weak admin passwords: Simple or reused passwords can give hackers full access to your website.

How to protect your website from e-skimming?

- Keep your website and plugins up to date: Outdated software is a common target. Regular updates close security gaps and strengthen your site’s defenses.

- Use a Content Security Policy (CSP): CSP limits which scripts can run on your site. If malicious code tries to send data elsewhere, CSP can block it.

- Monitor third-party services: Only use trusted external tools and keep them updated. Third-party scripts should come from reliable sources.

- Enable Multi-Factor Authentication (MFA): Strong passwords are important, but MFA adds an extra layer of security. It requires a second step—like a code sent to a phone—making unauthorized access harder.

- Scan your website regularly: Use security tools to check for malicious code. Early detection helps you fix issues before they cause harm.

- Encrypt data with HTTPS and SSL: While encryption doesn’t stop code injections, it protects data during transmission, making it much harder to intercept.

- Limit admin panel access: Restrict access to specific IP addresses and give each employee a unique login. This reduces the risk of unauthorized access and makes tracking easier.

E-skimming is like an invisible thief stealing customer data right under your nose. The good news? You can catch these threats early—or prevent them with the right security measures. The more you invest in website security, the safer your customers will feel, boosting their trust and loyalty to your business.v

Conclusion

Cyber threats in e-commerce are a real challenge that online stores face every day. Payment fraud, DDoS attacks, e-skimming, and other risks can harm your profits and, more importantly, damage customer trust. Rebuilding your reputation after a data breach is far more complex than preventing one.

To keep your website stable, protect customer data, and maintain trust, you need a comprehensive security approach. Installing an SSL certificate or updating your CMS is not enough. Adequate protection requires continuous monitoring, the use of modern technologies, and support from professionals who know how to defend your business.

At Vilmate, we’re ready to help you create a strong cybersecurity system for your e-commerce project. We offer more than technical solutions—we provide a complete security strategy tailored to your business.

Contact Vilmate today and let us help you make your online store safer, more reliable, and better protected against cyber threats.