A purchasing manager opens your B2B portal to reorder the same items they buy every month. Nothing exotic: negotiated prices, agreed volumes, standard delivery terms. Five minutes later, they’re still clicking through filters, checking PDFs, and wondering why the system suddenly asks them to “contact sales” for something they’ve already bought six times this year.

The platform isn’t broken. It’s just built for a different reality. What buyers expect today doesn’t match how most platforms still work.

For most B2B buyers, ecommerce is expected to feel routine, predictable, fast, and aligned with daily operations. When that doesn’t happen, workarounds appear—spreadsheets, emails, offline calls—and ecommerce quietly stops being the main channel.

Current trends in B2B ecommerce reflect this shift. The focus is moving away from feature lists and toward removing extra steps from real purchasing workflows.

This article looks at the B2B ecommerce trends shaping 2026 and explains how companies can adapt their platforms to fit modern buying behavior, not the other way around.

Key trends driving B2B ecommerce in 2026

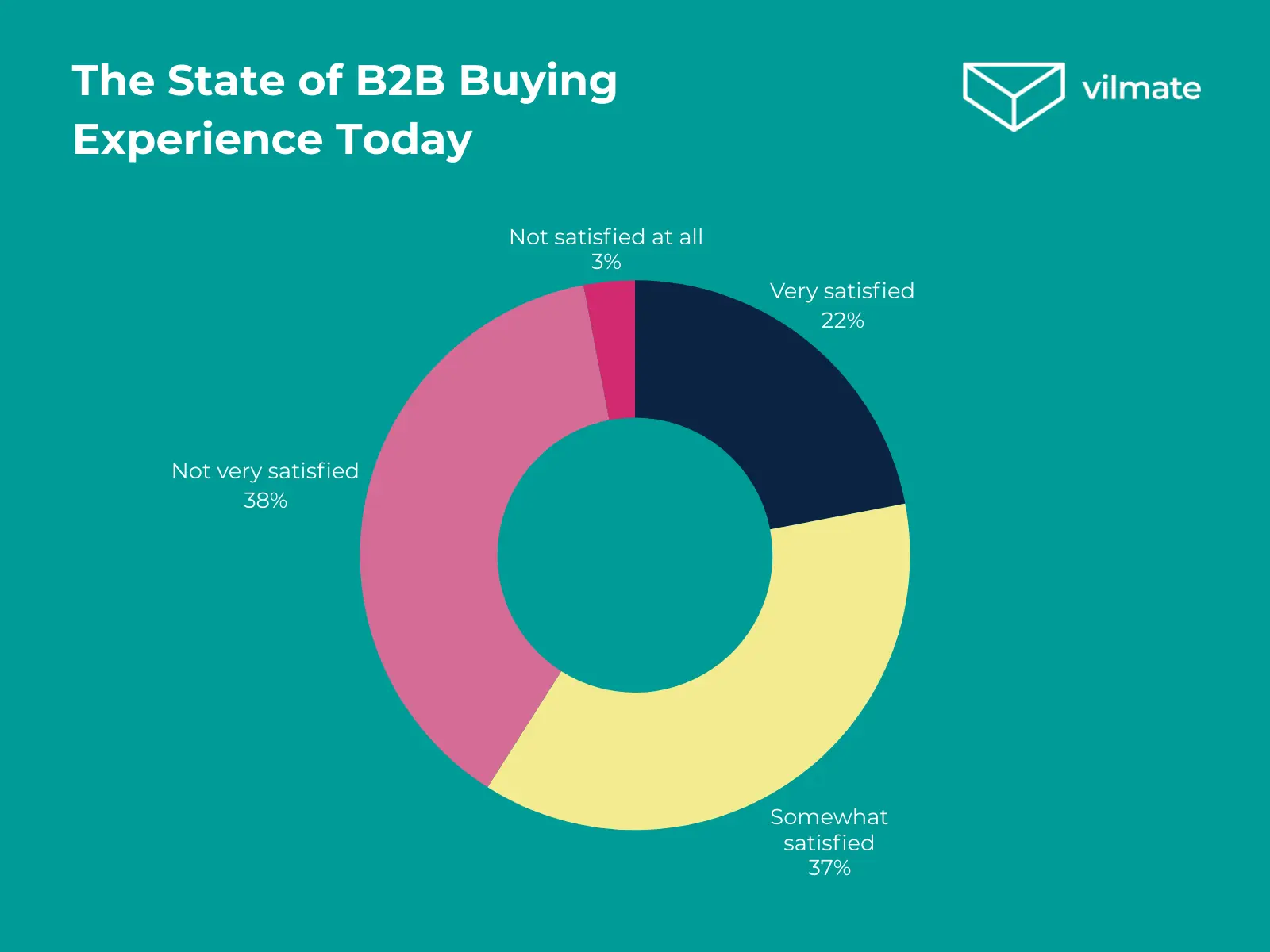

Picture this: in a recent industry survey, only 37% of B2B buyers said they were somewhat satisfied with their current purchasing experience—and another 38% said they weren’t very satisfied at all. Put simply, roughly three out of four business buyers feel the experience could be better. That’s not a critique of individual platforms, it’s a signal that expectations have shifted.

Source: sana

These numbers help explain the B2B ecommerce growth trends we see heading into 2026. Buyers aren’t just asking for more features; they’re asking for clarity, speed, autonomy, and coherence across systems they rely on every day.

Most of what’s changing fits into a small set of patterns:

- Rethinking platform architecture to support flexibility and integration rather than legacy workflows.

- Embedding personalization into actual operations—from pricing to product discovery—instead of treating it as a marketing add-on.

- Reducing dependency on sales reps for routine tasks through smarter self-service and guided interfaces.

- Making complex B2B workflows feel simpler through better UX, automation, and context-aware design.

- Connecting touchpoints—payments, subscriptions, inventory, channels—into a consistent experience rather than isolated modules.

Yes, that was a bit of a spoiler. But we’ll make the trends worth your time. Here’s where it gets specific.

#1 Modern platforms replace “it still works” systems

Most legacy B2B platforms don’t fail loudly. They just slow everything down.

A small change takes weeks. Integrations behave like fragile agreements. Frontend updates wait for backend approvals. Everyone learns to live with it—until ecommerce stops being optional.

Modernization is happening not because companies suddenly love new tech, but because old setups can’t keep up with how buying actually works today. Ecommerce is expected to connect systems, adapt quickly, and handle change without drama. Legacy platforms were never built for that pace.

In practice, modernization looks refreshingly unromantic. Companies break large, tightly coupled systems into smaller independent parts, let the frontend evolve without touching core business logic, and treat integrations as flexible connections rather than one-off fixes. The focus shifts away from “we’ll patch it later” solutions that quietly become permanent.

The goal is to make updates predictable and manageable rather than risky. Modern platforms make change boring—and that’s exactly why businesses move toward them.

#2 Personalization moves from marketing to how buying actually works

Personalization used to mean emails with a name in the subject line. In B2B, that era is quietly ending. The future of B2B e-commerce points toward something more practical: platforms that adapt not just what they say, but how purchasing itself works.

This shift is driven by expectations, not hype. According to a joint study by Adobe and Forrester, 66% of B2B buyers expect a fully personalized experience. This expectation is strongest when using a product or software (72%) and remains high during product discovery (57%). In other words, personalization is expected across the entire journey—before, during, and after the transaction.

What’s changing is the scope. B2B ecommerce personalization now extends beyond messaging into pricing logic, catalogs, and workflows.

So, today, businesses are focusing on:

- Customer-specific pricing, assortments, and availability by default.

- Product discovery that reflects past orders, roles, and real usage patterns.

- Workflows that adapt to how different customers approve, reorder, or customize purchases.

- Content and guidance that supports decisions, not just promotes products.

The goal is to remove decisions buyers have already made in the past. When personalization works at this level, buying feels faster—and strangely familiar—even when the platform itself is complex.

#3 Mobile experience becomes about speed, not adaptation

In B2B ecommerce, mobile has long been treated as a smaller version of desktop. Same screens, same logic, just squeezed into a tighter space. It’s technically usable, but exhausting in practice.

The numbers are telling: 96% of B2B buyers are not very satisfied with their mobile buying experience, which explains why mobile is still used cautiously rather than confidently.

The main issue is how mobile is used in B2B workflows. In B2B, buyers don’t open their phones to browse or explore options—they use them to take care of something quickly: approve an order, reorder a familiar product, check availability, fix a mistake, or confirm delivery. Interfaces built around long sessions, dense navigation, or desktop-first assumptions simply get in the way.

What’s changing is how mobile versions are designed—from “supported” to purpose-built:

- Speed as a primary requirement, not an optimization task.

- Interfaces designed for short, focused actions rather than exploration.

- Immediate access to repeat tasks like reorders, approvals, and status checks.

- Simplified navigation that prioritizes the next action over full visibility.

- Forms and controls that work reliably on touch, without precision or effort.

The goal is to design mobile around its specific purpose in B2B workflows. When platforms get that right, mobile stops feeling like a compromise—and starts pulling real weight in everyday B2B workflows.

#4 AI becomes infrastructure, not a selling point

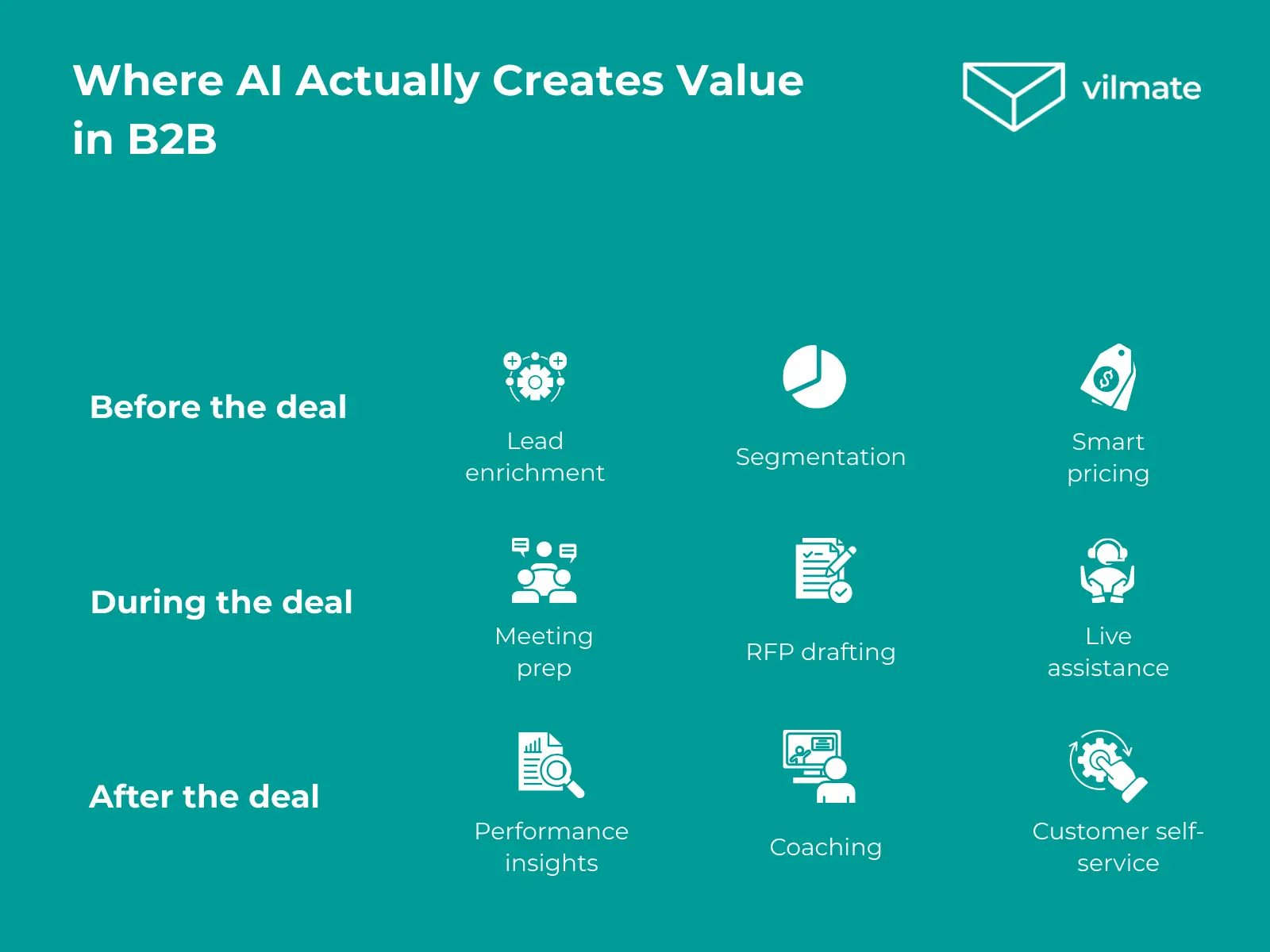

The conversation around AI in B2B ecommerce has noticeably changed. The early excitement has given way to a more practical question: where does AI actually help, and where does it just add noise?

Recent B2B research points to an important pattern. Companies that report strong B2B sales results—including 10% or more market share growth—are significantly more likely to be actively using AI. The same research shows a clear correlation between engagement with AI and revenue growth: businesses that take AI seriously, whether with enthusiasm or healthy skepticism, tend to outperform those that ignore it altogether.

This doesn’t mean AI is a guaranteed win. In fact, poorly applied automation often makes things worse. Overly confident recommendations, black-box decisions, or AI features without clear value quickly erode trust. That’s why the future of B2B e-commerce isn’t about adding AI everywhere, but about placing it carefully.

In B2B ecommerce, AI proves useful only in a few specific places:

- Automating routine actions like reorders, approvals, and data updates.

- Supporting product discovery with context-aware signals, not generic suggestions.

- Helping teams manage pricing rules, catalogs, and product data once the volume grows.

- Reducing manual effort in repetitive processes that don’t need human judgment.

And that’s exactly the point. AI creates value when it fades into the background, quietly making complex systems easier to use. That’s when it stops being controversial and starts earning its place.

#5 Complex workflows move behind the interface

B2B buying is complicated by nature. Multiple roles, approvals, contracts, exceptions... That part isn’t changing. What is changing is the tolerance for interfaces that make this complexity visible to everyone.

As more companies rely on B2B self-service portals, UX stops being about nice design and starts being about damage control. Every confusing screen, extra field, or unclear option pushes users back to emails, calls, and manual fixes. Self-service only works when the interface actively protects users from underlying complexity.

What’s happening now is a shift in UX priorities toward containment rather than exposure. Rules, conditions, and internal logic stay hidden until they actually matter. Flows are built around common tasks instead of system structure. Repeated decisions are pre-filled by default, choices are intentionally limited, and the next step is always obvious without explanation.

Good UX contains complexity and keeps B2B processes manageable.

When interfaces do that well, self-service scales. When they don’t, ecommerce quietly turns back into a support channel.

#6 Payments shift from checkout to long-term flow

In B2B ecommerce, payments are rarely just a final step. They shape how often customers reorder, how predictable demand becomes, and how much manual work sits around every transaction. That’s why flexibility in payment options is moving from a “nice extra” to a structural requirement.

What’s really driving change here is repetition. Businesses don’t want to rethink payments every time they place a familiar order. They expect the platform to remember terms, methods, and timing—and to apply them consistently. Subscription models take this logic to its natural conclusion: recurring purchases become routine rather than repetitive.

The scale of this shift is hard to miss. The global subscription ecommerce market is expected to reach $14.82 trillion by 2027, growing at an estimated 65.8% annually. That growth isn’t about novelty. It reflects demand for predictability—on both sides of the transaction.

The change is easier to spot in how payments repeat, not how they look:

- Familiar payment terms applied automatically.

- Recurring orders handled without reconfiguration.

- Billing and renewals happening in the background.

- Fewer exceptions that need manual follow-up.

The result is a buying flow that feels settled and reliable. And in B2B, that kind of calm is often what keeps customers coming back.

#7 Product discovery shifts toward visual and experiential formats

B2B product discovery has outgrown text, filters, and spec sheets. Buyers don’t want to decode descriptions anymore. They want to see how a product behaves in real conditions before they commit. That’s why video and AR are moving from “nice extras” into the core of discovery.

Richer content earns its place by preventing mistakes. When products are complex or configurable, static descriptions push too much work onto the buyer. Visual formats do the opposite. They show scale, usage, and trade-offs immediately, cutting down hesitation and back-and-forth.

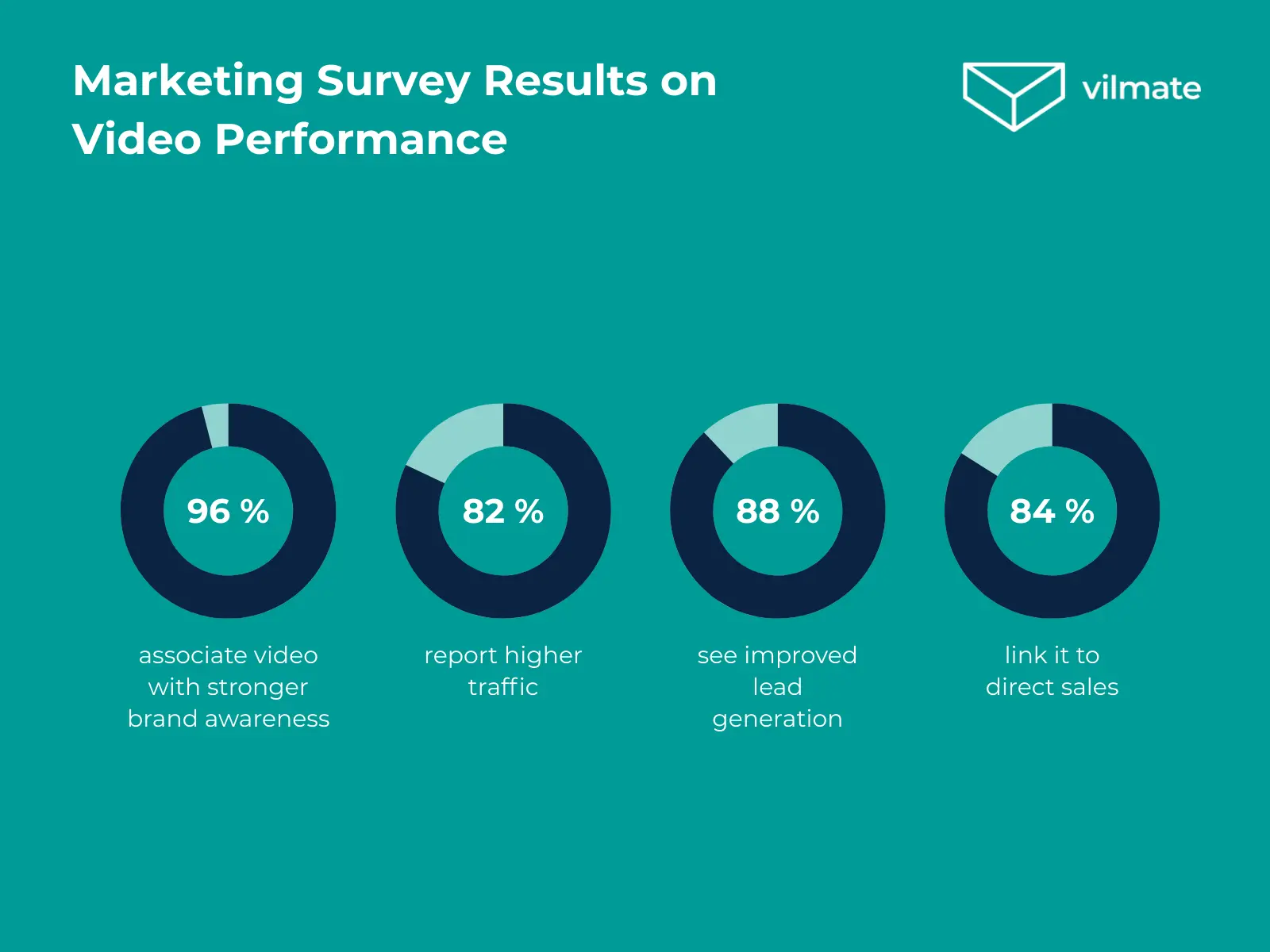

Source: wyzowl

The numbers back this up. 96% of marketers link video to stronger brand awareness. 82% see higher site traffic. 88% connect it to lead generation. And 84% report direct sales impact. Video doesn’t just attract attention, it changes how decisions are made.

Discovery is shifting from finding options to eliminating doubt. Walkthroughs, short demos, and AR previews don’t replace specifications. They put them in context. When buyers understand what they’re choosing earlier, everything that follows—configuration, approval, purchase—moves faster and breaks less often.

#8 Omnichannel experience: all touchpoints are logically connected

B2B buyers don’t think in channels. They move between systems the same way they move between tasks—without stopping to reset context. A portal, an email, a sales call, a message in a messenger all feel like parts of one conversation. Until they don’t.

That break happens often. Today, B2B customers typically interact with suppliers across ten or more channels. When each touchpoint runs on its own logic, the burden shifts to the buyer. Details get repeated. Decisions get rechecked. Progress slows for no obvious reason.

What companies are reacting to isn’t channel complexity, but coordination failure. Buyers expect pricing, order status, approvals, and history to follow them wherever the interaction continues. If something was agreed in one place, it shouldn’t need to be rediscovered in another.

Omnichannel experience increasingly centers on consistency across touchpoints. The systems behind portals, sales teams, support, and payments are expected to share context by default. When they don’t, customers fill the gaps manually. When they do, channels disappear—and the process feels reliable instead of fragmented.

In B2B, that reliability is the difference between a relationship that scales and one that constantly needs human intervention.

#9 Channel diversification extends beyond owned platforms

For a long time, B2B ecommerce revolved around one primary channel—the company’s own platform. Everything else was treated as support. That model doesn’t scale well once buyers start discovering, comparing, and even initiating purchases outside your ecosystem.

Channel diversification in B2B isn’t about being everywhere. It’s about meeting buyers where parts of the buying process already happen—and letting those touchpoints connect back to core systems instead of competing with them.

That’s why attention is spreading across a small but growing set of channels:

- Social commerce. Product discovery, early validation, and even inbound leads increasingly start on platforms buyers already use daily. Social channels stop being “marketing only” and begin feeding real commerce flows.

- Third-party marketplaces. Industry platforms and horizontal marketplaces act as comparison layers buyers trust. Presence there reduces friction at the evaluation stage and shortens the path to first contact.

- Direct integrations with external tools. Procurement systems, ERPs, and partner platforms are no longer edge cases. Integrations turn ecommerce into a background capability rather than a destination.

- Partner and reseller channels. Indirect sales regain importance when systems are connected tightly enough to keep pricing, availability, and order status consistent.

What matters most is how cleanly channels connect to inventory, pricing, and fulfillment systems. When diversification is handled well, channels amplify each other. When it isn’t, they fragment demand and increase operational noise.

In B2B ecommerce, channel strategy stops being a visibility exercise and turns into a systems problem.

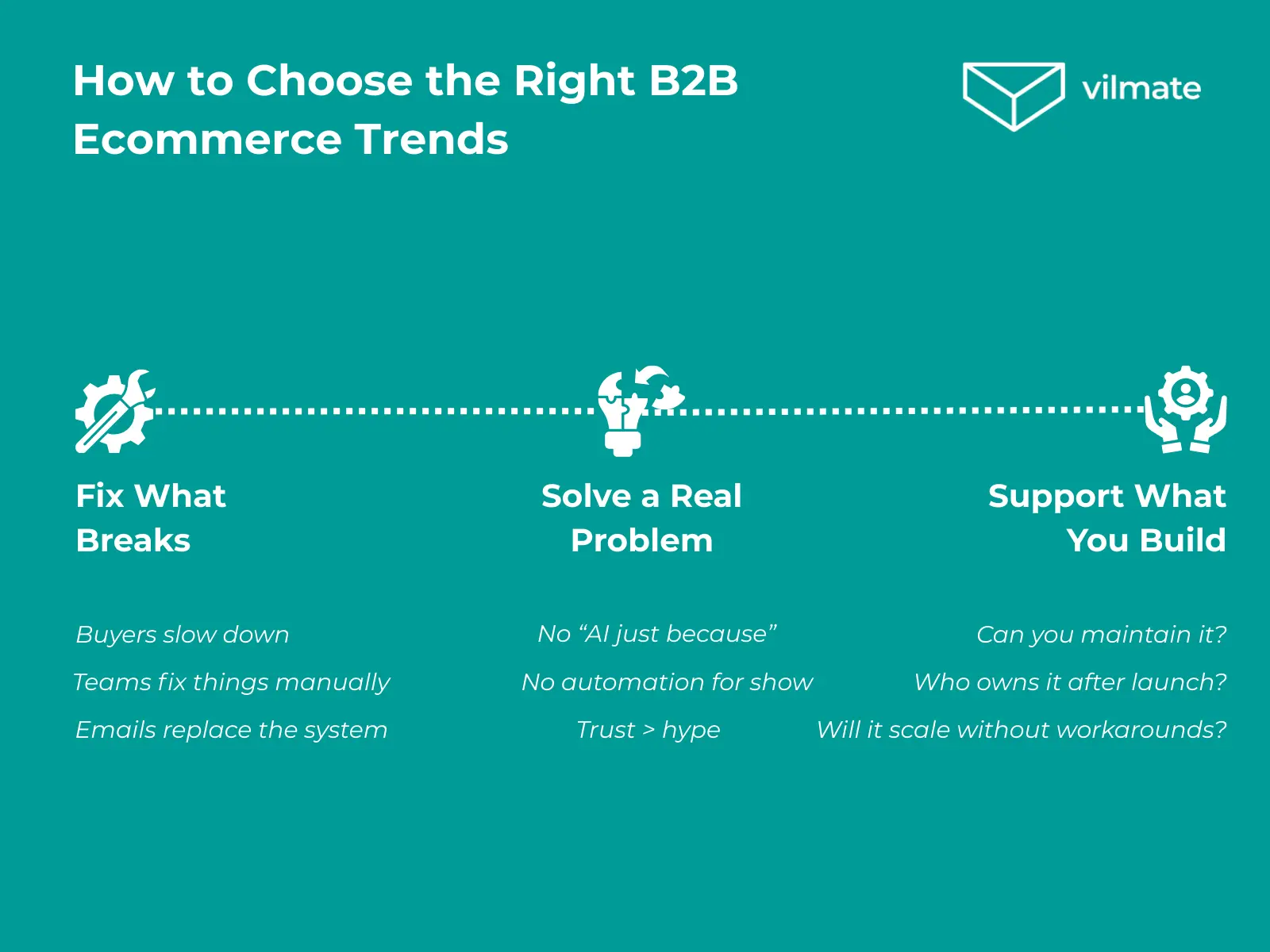

How to determine which trends to follow

Most of these trends will be useful over time. The problem starts when teams try to do all of them at once. That’s how platforms get cluttered and harder to use instead of better.

Fix what already breaks. Where buyers slow down, get confused, or leave and write an email instead. Where your own team fixes things by hand because the system can’t handle real situations. If a trend helps remove that pain, it’s worth attention. If it doesn’t, it can wait.

Skip trends without a clear problem. Adding AI, automation, or personalization just to “have it” often makes systems unpredictable. People stop trusting them. That’s how you end up in a very Black Mirror kind of setup: everything looks smart, but no one feels comfortable using it.

Back only what you can support. Some changes need serious engineering work. Others are mostly about simplifying flows and removing steps. Both are fine, as long as someone is responsible for them after launch. If not, they quickly turn into workarounds.

The real goal is making everyday work easier. If a change makes things calmer a few months later, it’s probably the right one.

Key takeaways

B2B ecommerce is moving away from feature lists and toward buyer behavior. Platforms win when they are reliable, clear, and aligned with how people actually buy, approve, and reorder.

Consistency is the common thread. Discovery, payments, workflows, and channels need to work as one system. When they do, friction drops and the platform becomes invisible in the best possible way.

There’s no universal roadmap. The right starting point depends on where your process already slows down.

If you’re planning your next step in B2B ecommerce innovation and want clarity before committing to major changes, let’s talk. At Vilmate, we turn trends into practical improvements that hold up in real use.

FAQs

How to decide what trends are fleeting and what is here to stay?

A simple test helps. If a trend changes what people do every day, it usually stays. If it mainly looks good in slides and demos, it rarely does. History is full of “next big things” no one asks about a year later.

How is AI changing B2B ecommerce buying and selling?

Mostly by doing the boring work. AI helps with reorders, approvals, and product discovery so people don’t have to. When AI starts demanding attention or explanations, something probably went wrong.

How can we future-proof our B2B ecommerce roadmap beyond 2026?

You can’t future-proof everything. You can make change cheaper. Flexible architecture, clean integrations, and clear workflows age better than big, tightly packed platforms built for one moment in time.

How long does it typically take to implement a B2B ecommerce solution?

Short answer: longer than a demo, shorter than people fear. Targeted improvements can ship in a few months. Full rebuilds usually take 9–18 months, depending on how many “we’ll fix it later” decisions need to be undone.